Taxonomy Implementation

Successful market uptake of Australia’s taxonomy is critical to mobilising private capital into activities that will decarbonise the Australian economy in line with the Australian Government’s 2035 emissions reduction target.

Taxonomy Market Implementation Program

Since the Australian sustainable finance taxonomy was published in June 2025, ASFI has taken on the role of taxonomy custodian.

As a part of this custodian role, ASFI is currently undertaking market outreach, education, and supporting implementation pilots to drive market uptake of the taxonomy including for labelled debt products. This world-first taxonomy market implementation program is in response to the experience of other voluntary jurisdictions that have experienced limited market uptake and under-utilisation of their taxonomies.

Pilot Participants

ASFI is working with 11 pilot participants, ANZ, Bank of China, Commonwealth Bank of Australia, Clean Energy Finance Corporation (CEFC), HESTA, Metrics Credit Partners, Moody’s Ratings, NAB, Rabobank, Rest Super, Westpac, as well as with the Australian Office of Financial Management and State Treasury Corporations to develop taxonomy-aligned labelled bond guidance.

Findings from the pilot program will be shared to support taxonomy adoption and market practice. These findings will also help support Government considerations on initial use cases for a taxonomy in Australia’s financial and regulatory architecture, in the line with the commitments outlined in the Australian Government’s Sustainable Finance Roadmap.

Alongside these leading financial institutions, the program brings together state central financing authorities, the Commonwealth Australian Office of Financial Management (AOFM) and market intermediaries, including data providers, certifiers and assurers.

Objectives of the Australian Sustainable Finance Taxonomy

Drive capital into activities that will decarbonise the economy at the speed and scale required to reach our climate commitments under the Paris Agreement.

Improve the quality of information available to the market to ensure sustainability definitions are credible, comparable and usable to promote transparency and trust and reduce greenwashing.

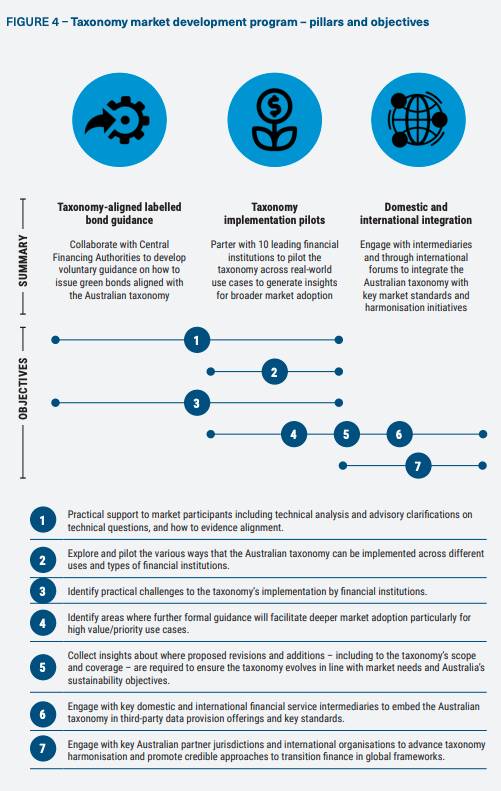

The program brings together leading financial institutions, state central financing authorities, the Commonwealth Australian Office of Financial Management (AOFM) and market intermediaries, including data providers, certifiers and assurers to pursue seven objectives through three streams, as illustrated in Figure 4.

Taxonomy Pilot Program Insights Report:

Unlocking Private Capital for the Transition: Market insights from the practical application of the Australian Sustainable Finance Taxonomy is the first research paper from the Taxonomy Implementation Program.

The report shares early market insights from the first practical applications of the Australian Sustainable Finance Taxonomy by ten major financial institutions, and reveals key enablers to drive widespread market adoption and unlock capital at scale.

The findings highlight that expanding the taxonomy to include climate adaptation and resilience is a low-cost, high impact opportunity and include calls for regulatory guidance, international interoperability and long-term governance to build confidence and accelerate adoption.

Proxy framework

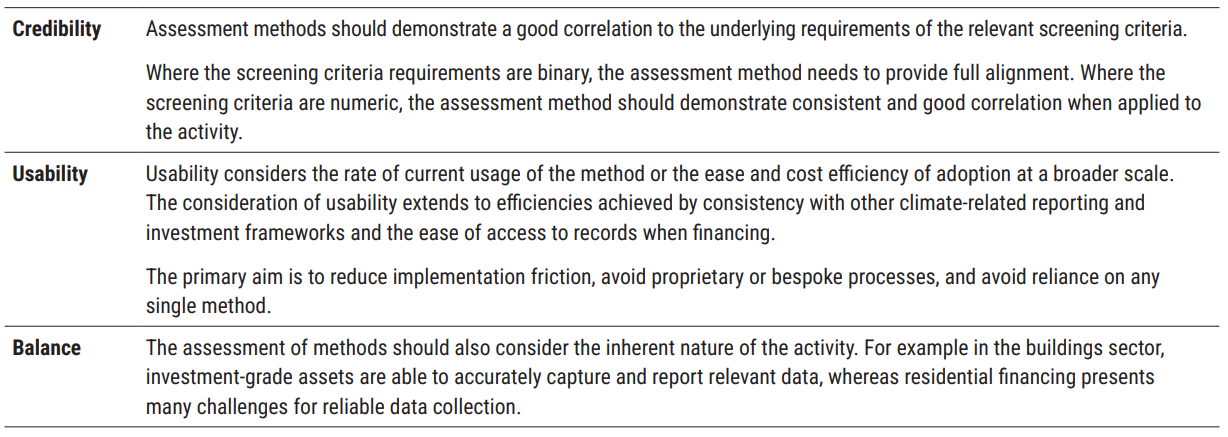

To help demonstrate alignment with the taxonomy, existing independently certified standards, codes, ratings or labelling schemes may be assessed and recognised under the Australian taxonomy’s proxy framework.

Contact us to get involved

If your organisation is interested in participating in the taxonomy implementation pilot program or having a proxy assessed, please send an enquiry through to info@asfi.org.au